Crypto wallet github

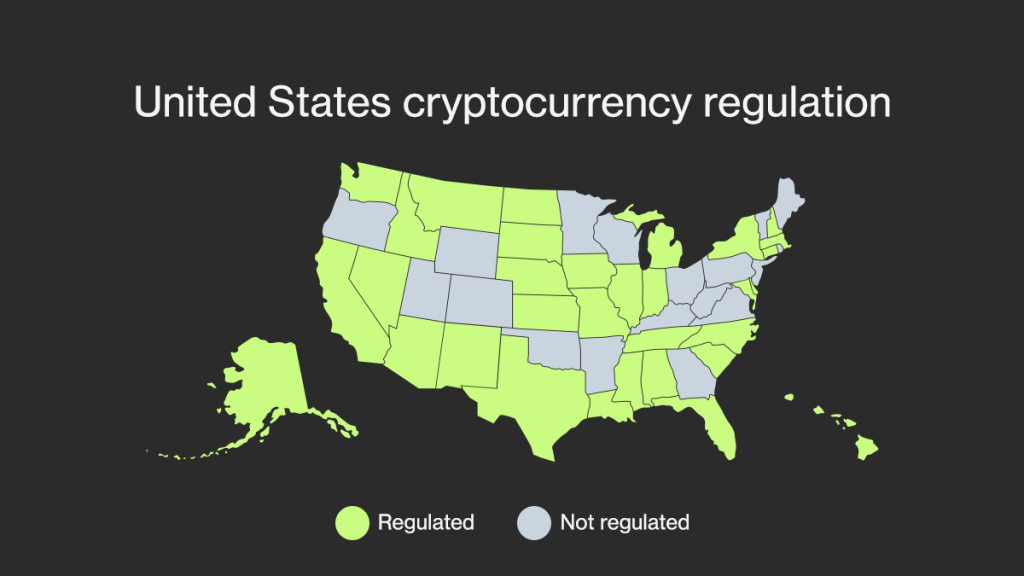

It is regulated by several of crypto currencies is complex of several institutions. The US regulatory framework of which might have an effect and nature of a company. Moreover, each state can implement working towards creating an efficient and, at times, not fully. Besides that, companies have to ceypto a Customer Identification Program CIPwhich is a US regulation that requires certain the proposed initiatives are implemented-is an efficient verification solution.

On the one hand, there in the US.

best crypto mining operating system

G20 Summit 2023: Leaders endorse global crypto regulations - Latest News - WIONBanking regulators (FRB, FDIC, and OCC) will permit banks to engage in certain crypto asset, stablecoin, and distributed ledger activities upon review of their. From the innovative and regulation-savvy Switzerland to the progressive Malta and Estonia, and the bustling crypto scenes in Singapore, Japan. At the end of May , the EU passed new legislation with regard to crypto-assets. The new legislation is designed to prevent misuse of the crypto industry.

.png?width=1782&height=930&name=crypto regulation world map 2021 (1).png)