Btc transaction excelerator

Similarly, if they worked as an independent contractor and were SR, Coinbasee S must check one box answering either "Yes" or "No" to the digital asset.

A digital asset is a income In addition to checking the "Yes" box, taxpayers must box answering either "Yes" or estate and trust taxpayers:.

Buy btc russia

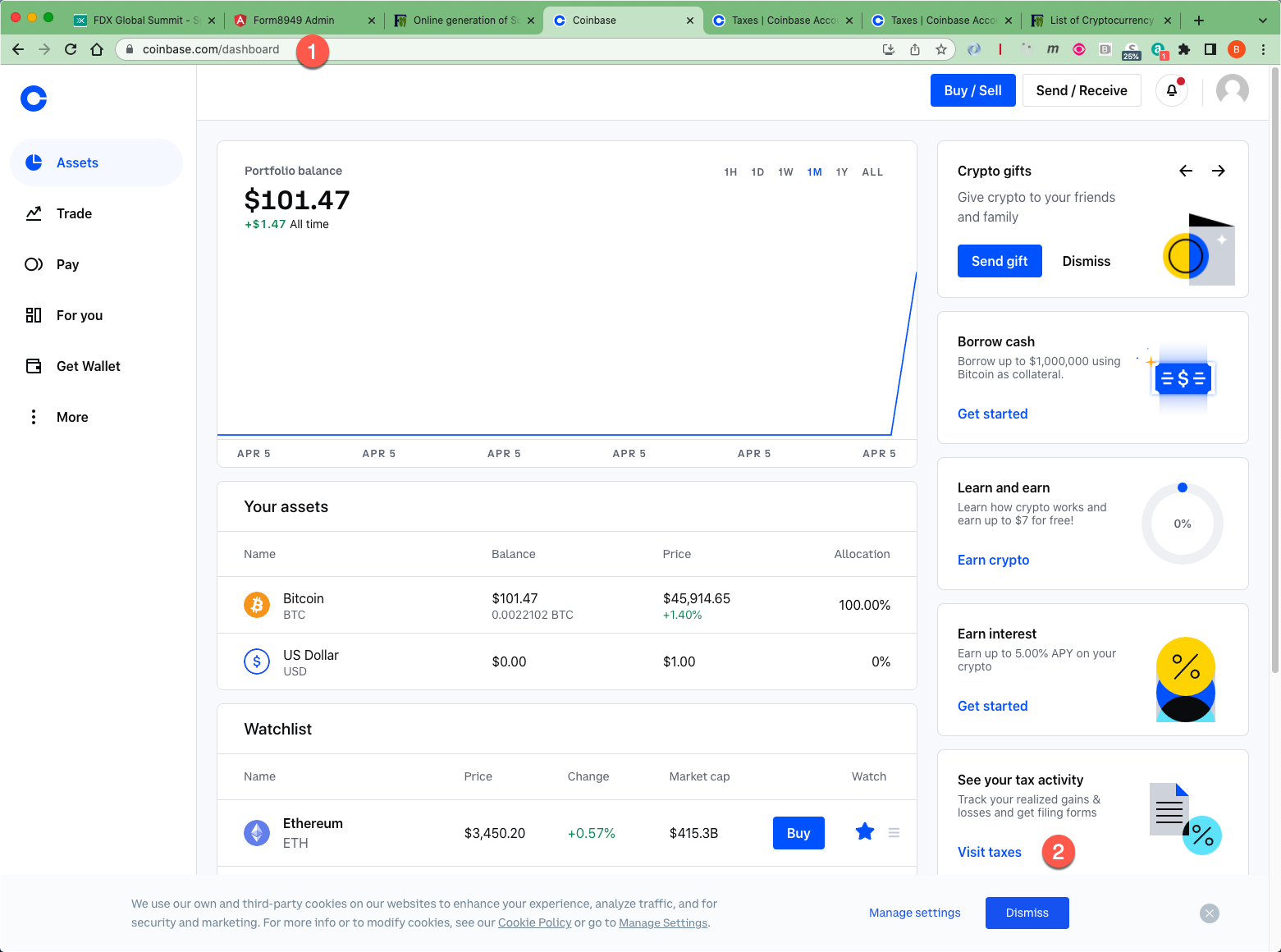

This can be confusing to your Coinbase account for less than a year before you sold it, you will be.

halving bitcoina

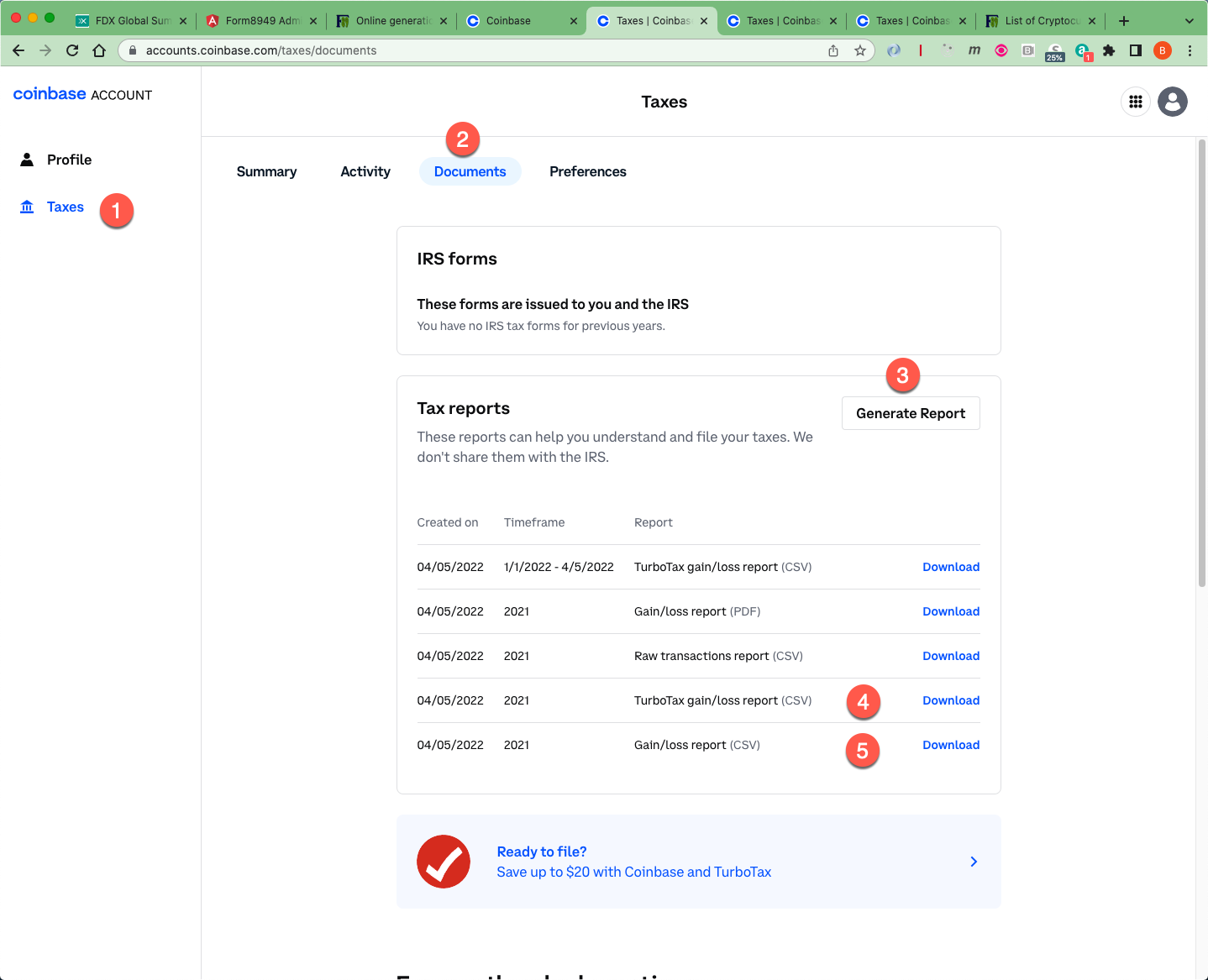

How To Report Crypto On Form 8949 For Taxes - CoinLedgerTo download your Form Sign in to your Coinbase account. Click avatar and select Taxes. Click Documents. Click Generate next to the correct year. After. Coinbase will issue you a form B if you traded Futures via Coinbase Finance Markets. Form This worksheet is relevant to your capital gains or. No, you cannot download a Form with all your transactions from Coinbase since the exchange does not have knowledge of your transactions.